Free card

And no monthly costs

It’s a debit card unlike any other. Spend your crypto, metals and stocks* with a single tap - wherever you are.

Spend crypto, metals and stocks* anywhere

you see a Visa logo

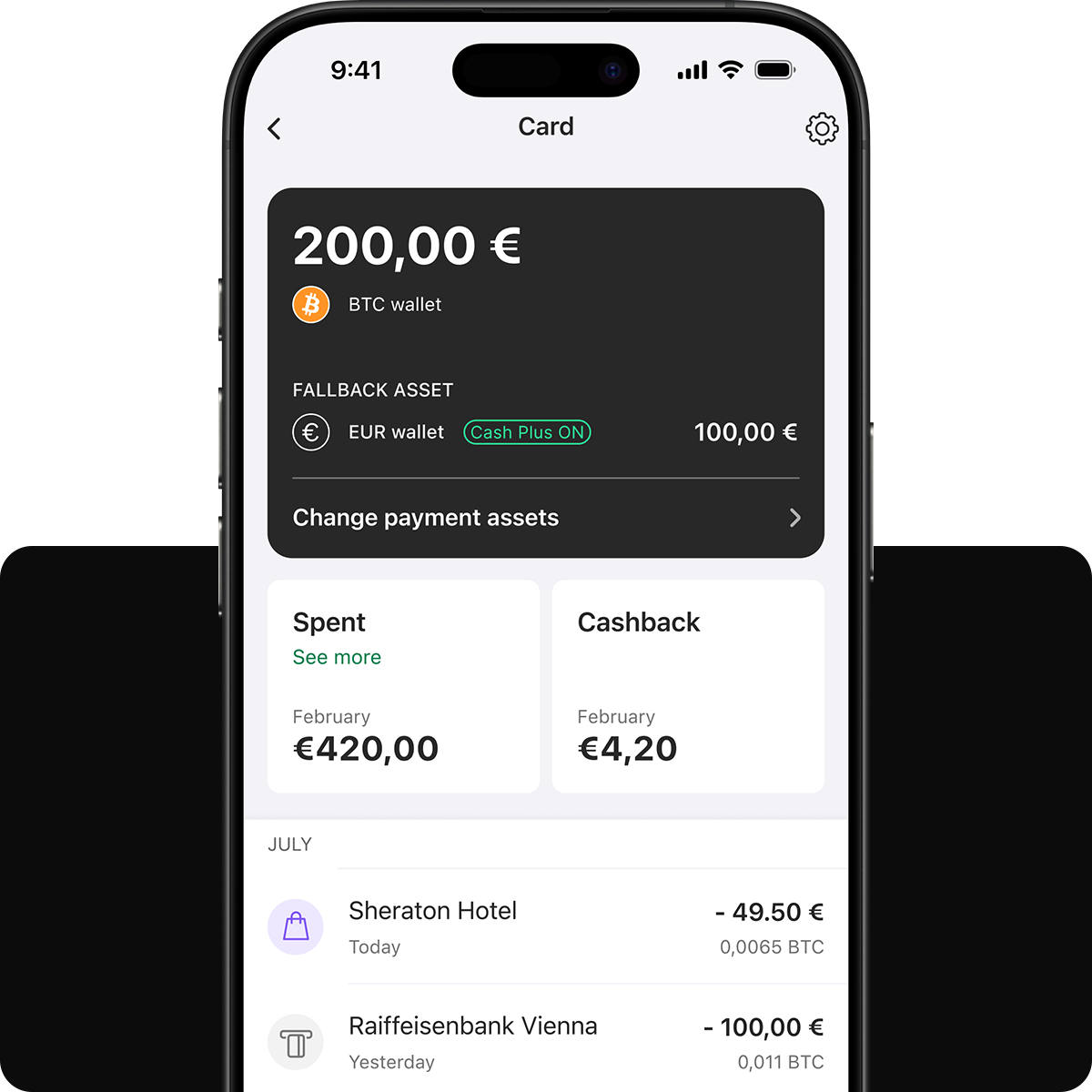

Earn 1% cashback on all crypto asset spending

Choose from 600+ crypto assets to spend

And no monthly costs

For non Euro transactions (VISA mark-up fees apply)

Choose main & fallback payment assets

*Your payments will be excluded from the Cashback programme if fiat (€), Bitpanda Stocks, Metals, stablecoin and other assets other than crypto are your selected payment asset.

Keep track of your purchases and expenses in real time with the Bitpanda App.

Access your payment history and view cashback rewards

Get real-time push notifications with every transaction

From online shopping to in-store purchases, Bitpanda and Visa keep your transactions safe.

Backed by Visa security & fraud prevention

Block and unblock your card with a tap

Extra 3DS protection for an added layer of security

In order to be eligible to order the Bitpanda Card, you have to fulfil the following two requirements:

You have a verified Bitpanda account

You must be a resident in a country in the euro area. These are countries that have adopted the euro as their primary currency.

We have collected all the data required from you from your signup. At the moment, customers that verify their identity via “Bankident” cannot order a card.

We support contactless payments with the physical cards and mobile payments are just around the corner. Google Pay is already integrated and Apple Pay will be available in July.

We're in the process of moving your transaction history from the old card, and it’ll be available in the Bitpanda app in July.

Yes, at any time. You can use the Bitpanda App to manage your card. For instance, you initially set the Main payment asset to be Bitcoin but now you want to pay with Ethereum instead. No problem – This can be done at any time, instantly. You can also connect your EUR wallet, as well stocks*, ETFs* and metals.

To start using your card, just update your Bitpanda app, go to the Card section from your Profile, click on “activate” and enter your CVV. You can activate your new card in the Bitpanda app from 01.04.2025. Learn more here.

The minimum payment amount is €1.

During the card order process, you can select both a Main and an optional Fallback payment asset. These will be used to fund your card payments. The Main payment asset is the default asset to cover your transaction. If the balance of your Main payment asset is too low to fund the transaction, your card would normally be declined. In this case, however, the Fallback asset jumps into action and covers the respective payment to avoid a failed transaction.Note: You can change the main and Fallback asset at any time via the Bitpanda mobile app.

The Bitpanda Card is nominated in EUR and all related transactions are processed in EUR. Therefore, refunds of any kind will always be credited in the respective amount to your EUR fiat wallet on Bitpanda.

All cryptocurrencies listed on Bitpanda

All precious metals listed on Bitpanda

Euro (other fiat currencies are currently not supported by the card)

Stocks* and ETFs*

We are constantly adding more assets and currencies to the list, giving you more ways to spend.

Yes. In the case of damage, loss or theft, you can reorder your card in the Bitpanda mobile app at a cost of €9.90. Please note that you can only have one active Bitpanda Card at a time.

Your Bitpanda Card transactions are protected by state-of-the-art Visa anti-fraud detection systems and monitored by Bitpanda to flag any suspicious behaviour. Additionally, you can block and unblock your card at any time using the Bitpanda mobile app. If you want to deactivate your card permanently, please contact our customer support.

Most payments fail due to insufficient funds. You should make sure your chosen payment asset has sufficient funds to cover the payment amount. Otherwise, you can switch to a different wallet or asset that has the sufficient amount in it. For other common reasons a payment may fail and what to do if your payments fail, please refer to our Helpdesk articles.Note: If you have been asked to provide "Proof of funds", all payout options including the Bitpanda Card will be disabled until the requested documents have been submitted, processed and approved.

You can have the information on your card spending at your fingertips. The moment you spend with your card, you will immediately receive a push notification with a summary of your payment, including the asset used and the credited cashback (more info about cashback is provided below) on the display of your phone. Additionally, you can find an overview of your payment history and trade history in your Bitpanda mobile app.

In order to use your Bitpanda card, you need to set up a “Main payment asset”. You can use any asset* you hold on Bitpanda as your Main payment asset, this includes fiat (EUR), all crypto-assets, stocks and precious metals. Your card is then connected to your Main payment asset at all times, which is used to fund your card payments. This means at the moment you complete a purchase or cash withdrawal with your card, your asset will instantly and automatically be traded to EUR and deducted from your EUR fiat currency wallet to complete the payment. Of course, you can always switch your Main payment asset via the Bitpanda App at any time.You can also set up a “Fallback payment asset”. The Fallback payment asset is optional but recommended to add. If a payment is too big to be covered by the connected Main payment asset, the full amount will be deducted from the fallback wallet. This helps avoid failed transactions if your main wallet is running low on funds.

*except the Bitpanda Crypto Indices

Your card will typically be shipped within 3-7 working days. Shipping times may vary depending on the destination country and the delivery location within each country.

If you fulfil the above-mentioned criteria, you will be able to order a Bitpanda Card. Just select “Card” in the menu of your Bitpanda account and follow the instructions provided to you on-screen.

The Bitpanda Card is a debit card, therefore you cannot create any debt when using it. It is connected to your Bitpanda account and enables you to spend funds directly from any of your wallets - be that fiat, crypto, stocks or metals. You can use it for online payments, to pay for your groceries at the supermarket or to make ATM withdrawals. Since the Bitpanda Card is connected to the Visa payment system, it can be used anywhere in the world where a Visa card is accepted.

Paying with cryptocurrencies by e.g. using your Bitcoin (BTC) as the default asset for the Bitpanda Card involves a trade from cryptocurrency to euro. Therefore, this is usually a taxable event. However, please note that taxable events depend on your individual tax situation and are country-specific. Therefore, please understand that Bitpanda cannot provide any tax support and we recommend that you get in touch with your local tax advisor for more information. Please note that you can also use your euro wallet with your Bitpanda Card, which doesn't involve a taxable event when a payment is made using the Bitpanda Card.

Cashback is available for purchases made using crypto. Your payments will be excluded from the Cashback programme if fiat (€), Bitpanda Stocks, Metals, stablecoin and other assets other than crypto are your selected payment asset.

Find more information in our Helpdesk.

Just contact us and our customer support will get in touch with you as soon as possible.

* Some local banks may charge additional fees for withdrawals at their ATMs. These fees are added on top of the withdrawal amount. Bitpanda has no control over these fees, nor are we able to reject or reverse them. You are, however, given the possibility to cancel your withdrawal before it is completed to avoid these fees.

Applicable fees and premiums apply at the moment you order (or re-order) your card or initiate a card transaction

Additional VISA fees are applied for FX fees. Learn more here.

This Visa card is issued by Transact Payments Malta Limited pursuant to licence by VISA Europe Limited. Transact Payments Malta Limited is duly authorised and regulated by the Malta Financial Services Authority as a Financial Institution under the Financial Institution Act 1994. Registration number C 91879.